Yes, in the state of New Jersey you are required to have auto insurance.

Nothing wrong, but there is always a risk when you switch polices that you could be subject to a new contestability period. You start a new, 2-year contestability period anytime you switch. If you die during that 2-year period, the insurance company can (and probably will) investigate the statements you made on your application. If you’ve given inaccurate or incomplete answers, the company may (and probably will) refuse to pay the death benefit.

Personal Injury Protection (also known as PIP) is your medical coverage for injuries you (and others) suffer in an auto accident. PIP pays if you or other persons covered under your policy are injured in an auto accident. It is sometimes called “no-fault” coverage because it pays your own medical expenses no matter who caused the auto accident.

Liability coverage pays others for damages from an auto accident that you cause. It also pays for a lawyer to defend you if you are sued for damages that you cause.

Uninsured Motorist Coverage pays you for property damage or bodily injury if you are in an auto accident caused by an uninsured motorist. Claims that you would have made against the uninsured driver who caused the accident are paid by your own policy. Uninsured motorist coverage does not pay benefits to the uninsured driver.

Underinsured Motorist Coverage pays you for property damage or bodily injury if you are in an auto accident caused by a driver who is insured, but who has less coverage than your underinsured motorist coverage.

Collision Coverage pays you for damage to your vehicle as the result of a collision with another car or other object. Collision coverage pays you for damage that you cause to your automobile.

Comprehensive Coverage pays for damage to your vehicle that is not a result of a collision, such as theft of your car, vandalism, flooding, falling objects, fire or a broken windshield. However, it will pay if you collide with an animal.

“Fully paid up” means just that. You have made enough premium payments to cover the cost of insurance for the rest of your life.

The company plans to use the cash value to pay premiums until you die. If you take cash value out, there may not be enough to pay premiums. The company could require you to resume paying premiums, or reduce the amount of the death benefit to an amount that the remaining cash value will support.

Personal Injury Protection (also known as PIP) is your medical coverage for injuries you (and others) suffer in an auto accident. PIP pays if you or other persons covered under your policy are injured in an auto accident. It is sometimes called “no-fault” coverage because it pays your own medical expenses no matter who caused the auto accident. PIP has two parts — (1) coverage for the cost of treatment you receive from hospitals, doctors and other medical providers and any medical equipment that may be needed to treat your injuries and (2) reimbursement for certain other expenses you may have because you are hurt, such as lost wages and the need to hire someone to take care of your home or family. You may purchase both parts of PIP coverage or medical treatment coverage only, depending upon your needs.

“Buy term and invest the difference” has been a popular sales slogan for term life. The pitch compares term, the least expensive form of life insurance, with other kinds of life insurance.

Example:

- $100,000 death benefit at age 35

- Annual whole life premium: $1,800

- Annual renewable term premium: $250

- Difference: $1,550

What are your choices?

- Buy whole life. The “difference” is used to keep your premiums lower than the actual cost of insurance as you get older.

- Buy term. You keep the difference.

In addition, make sure you consider the following:

- As you get older your term premiums will increase to keep up with the cost of insurance;

- If you invested the difference, you could use your investment to pay the higher cost of insurance;

- If you spent the difference you will have to dip into other savings to pay higher premiums; and

- If your health deteriorates you may not be able to buy a new policy

Liability coverage pays others for damages from an auto accident that you cause. It also pays for a lawyer to defend you if you are sued for damages that you cause.

Bodily Injury Liability Coverage pays for claims and lawsuits by people who are injured or die as result of an accident you cause. It compensates others for pain, suffering and economic damages, such as lost wages. This coverage is typically given as two separate dollar amounts: (1) an amount paid per individual and (2) an amount paid for total injuries to all people injured in any one accident that you cause.

Property Damage Liability Coverage pays for claims and lawsuits by people whose property is damaged as a result of an auto accident you cause.

The rest of the money paid for insurance. You were entitled to only the cash surrender value — that is, the amount you had paid to “pre-fund” insurance in your old age. The amount would have been even less if you had borrowed money that had not yet been repaid.

An uninsured motorist is a driver who does not have the minimum level of insurance required by law.

Read your policy. It has a table of cash values that should provide the answer. Call your agent if you are still not sure of the cash value amount.

Uninsured Motorist Coverage pays you for property damage or bodily injury if you are in an auto accident caused by an uninsured motorist. Claims that you would have made against the uninsured driver who caused the accident are paid by your own policy. Uninsured motorist coverage does not pay benefits to the uninsured driver. (Claims paid under uninsured or underinsured motorist coverage exclude the first $500 in damages.)

When you die, the insurance company will pay the death benefit. No matter how much cash value you may have had in the policy the moment before you died, your beneficiaries can collect no more than the stated death benefit. Any loans you have not repaid (plus interest) will be subtracted from the death benefit.

The result: your beneficiary could wind up with less than the face amount of the policy.

The exception: some whole life policies pay both the death benefit and the cash value when you die.

Underinsured Motorist Coverage pays you for property damage or bodily injury if you are in an auto accident caused by a driver who is insured, but who has less coverage than your underinsured motorist coverage. When damages are greater than the limits of the other driver’s policy, the difference is covered by your underinsured motorist coverage. (Claims paid under uninsured or underinsured motorist coverage exclude the first $500 in damages.)

Face amount means the dollar amount in a life insurance policy to be paid to the beneficiary when the insured dies. It does not include other amounts that may be paid from insurance purchased with dividends or any policy riders.

Collision Coverage pays you for damage to your vehicle as the result of a collision with another car or other object. Collision coverage pays you for damage that you cause to your automobile. You can also make a claim under your own collision coverage for damage to your car from an auto accident you did not cause. This may take less time than making a property damage liability claim against the driver who caused the auto accident. Your insurer then seeks reimbursement from the insurer of the driver who caused the auto accident.

Guaranteed insurability is an option that permits the policyholder to buy additional stated amounts of life insurance at stated times in the future without evidence of insurability.

Comprehensive Coverage pays for damage to your vehicle that is not a result of a collision, such as theft of your car, vandalism, flooding, falling objects, fire or a broken windshield. However, it will pay if you collide with an animal.

The NFIP is a Federal program created by Congress to mitigate future flood losses nationwide through sound, community-enforced building and zoning ordinances and to provide access to affordable, federally backed flood insurance protection for property owners. The NFIP is designed to provide an insurance alternative to disaster assistance to meet the escalating costs of repairing damage to buildings and their contents caused by floods.

Participation in the NFIP is based on an agreement between local communities and the Federal Government that states that if a community will adopt and enforce a floodplain management ordinance to reduce future flood risks to new construction in Special Flood Hazard Areas (SFHAs), the Federal Government will make flood insurance available within the community as a financial protection against flood losses.

Premium is the amount of money an insurance company charges for insurance coverage.

In support of the NFIP, FEMA identifies flood hazard areas throughout the United States and its territories. Most areas of flood hazard are commonly identified on Flood Insurance Rate Maps (FIRMs). Areas not yet identified by a FIRM may be mapped on Flood Hazard Boundary Maps (FHBMs). Several areas of flood hazards are identified on these maps. One of these areas is the

Special Flood Hazard Area (SFHA).

The SFHA is a high-risk area defined as any land that would be inundated by a flood having a 1-percent chance of occurring in a given year (also referred to as the base flood). The high-risk-area standard constitutes a reasonable compromise between the need for building restrictions to minimize potential loss of life and property and the economic benefits to be derived from floodplain development. Development may take place within an SFHA, provided that development complies with local floodplain management ordinances, which must meet the minimum Federal requirements. Flood insurance is required for insurable structures within high-risk areas to protect Federal financial investments and assistance used for acquisition and/or construction purposes within communities participating in the NFIP.

The Special Automobile Insurance Policy (SAIP) is a new initiative to help make limited auto insurance coverage available to drivers who are eligible for Federal Medicaid with hospitalization. Such drivers can obtain a medical coverage-only policy at a cost of $365 a year.

A Flood Insurance Rate Map (FIRM) is an official map of a community on which FEMA has delineated both the special hazard areas and the risk premium zones applicable to the community.

The maximum dollar amount the insurer will pay following an auto accident. Limits vary with each coverage within the policy.

Flood is defined in the Standard Flood Insurance Policy (SFIP), in part, as:

A general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties (at least one of which is your property) from overflow of inland or tidal waters, from unusual and rapid accumulation or runoff of surface waters from any source, or from mudflow.

For a complete definition, call us at 973.627.5500.

Deductibles are payments you have to make before the insurer pays for a covered loss. For example, a $750 deductible means that you pay the first $750 of each claim.

If you feel you need a high level of PIP coverage but want to reduce your premium, you can save money by agreeing to pay more out of pocket through a higher deductible if you are injured in an auto accident. Your insurer will pay the medical bills over the deductible amount you choose. No matter what deductible you choose, there is a 20 percent co-payment for medical expenses between the deductible selected and $5,000. That means you pay 20 percent, and your insurer pays 80 percent.

As established by the U.S. Congress, the sale of flood insurance under the NFIP is subject to FEMA rules and regulations. FEMA has elected to have state-licensed insurance companies’ agents and brokers sell flood insurance to consumers. State regulators hold the insurance companies’ agents and brokers accountable for providing NFIP customers with the same standards and level of service that the states require of them in selling their other lines of insurance.

A claim is a request to an insurer for payment or reimbursement of a loss covered by the terms of an insurance policy.

Individuals can phone the general NFIP information number at 1-800-427-4661 to find out if their community participates in the CRS and to learn about the amount of the premium discount.

Cost savings can also be achieved by using your own health insurance as a primary source of coverage in the case of injury related to an auto accident. Before selecting this option, you should find out if your health insurance will cover auto accident injuries and how much coverage is provided. Medicare and Medicaid cannot be used for the Health Care Primary Option.

The decision to join the CRS is a voluntary action of a community’s elected officials. As with many community actions, citizens can contact their local elected officials and encourage the community to consider learning more about joining the CRS. Additional technical assistance resources are available through 1-800-427-4661, which can provide further assistance about joining the CRS. The CRS website (http://www.fema.gov/business/nfip/crs.shtm) also provides additional contact information for technical assistance with applying for the CRS.

Income Continuation — If you cannot work due to accident-related injuries, this coverage pays lost wages, less Temporary Disability Benefits you may receive if your disability prevents you from working, up to the amount you select.

Essential Services — Pays for necessary services that you normally do yourself, such as cleaning your house, mowing your lawn, shoveling snow or doing laundry, if you are injured in an auto accident.

Death Benefit — In the case of death, family members or estates will receive any benefits not already collected under the income continuation and essential services coverages.

Funeral Expense Benefit — Pays for reasonable funeral expenses up to the limit you select if you die as a result of an auto accident.

NFIP coverage is available to all owners of eligible property (a building and/or its contents) located in a community participating in the NFIP. Owners and renters may insure their property against flood loss. Owners of buildings in the course of construction, condominium associations, and owners of residential condominium units in participating communities all may purchase flood insurance.

Condominium associations may purchase insurance coverage on a residential building, including all units, and its commonly owned contents under the Residential Condominium Building Association Policy (RCBAP). The unit owner may separately insure personal contents as well as obtain additional building coverage under the Dwelling Form as long as the unit owner’s share of the RCBAP and his/her added coverage do not exceed the statutory limits for a single-family dwelling. The owner of any condominium unit in a non-residential condominium building may purchase only contents coverage for that unit.

The Unlimited Right to Sue and Limited Right to Sue options only cover lawsuits for “pain and suffering” or noneconomic losses. Your medical expenses and some economic losses for injuries in auto accidents will be paid up to the limits of your PIP coverage and are not affected by the choice you make here.

The choice you make regarding your right to sue another driver applies to you, your spouse, children and other relatives living with you who are not covered under another automobile insurance policy.

When you choose the unlimited right to sue option, you retain the right to sue the person who caused an auto accident for pain and suffering for any injury.

By choosing the limited right to sue option, you agree to not sue the person who caused an auto accident for your pain and suffering unless you sustain on of the permanent injuries listed below:

- Loss of body part

- Significant disfigurement or significant scarring

- A displaced fracture

- Loss of a fetus

- Permanent injury (any injury shall be considered permanent when the body part or organ, or both, has not healed to function normally and will not heal to function normally with further medical treatment based on objective medical proof.)

- Death

(Choosing this option does not affect your ability to sue for economic damages such as medical expenses and lost wages.)

The choice you make affects how much your insurance will cost and what claims will be paid in the event of an accident.

Insurance companies or their producers or representatives shall not be held liable for your choice of lawsuit option (Limited Right to Sue or Unlimited Right to Sue) or for your choices regarding amounts and types of coverage. You cannot sue an insurance company or its producers or representatives if the Limited Right to Sue option is imposed by law because no choice was made on the coverage selection form. Insurers and their producers or representatives can lose this limitation on liability for failing to act in accordance with the law.

See N.J.S.A. 17:28-1.9 for more information.

NFIP coverage is available only in participating communities. Almost all of the nation’s communities with serious flooding potential have joined the NFIP. The NFIP provides a list of participating communities in the Community Status Book. To learn if your community participates in the NFIP, refer to this list online at www.fema.gov/national-flood-insurance-program/national-flood-insurance-program-community-status-book or contact your community official or us at 973.627.5500.

Under the tier rating system, insurers assign drivers to different tiers, or rating levels, based on a number of risk characteristics. Tier rating systems take the “complete picture” into account to identify a good risk, rather than simply penalizing drivers for accidents and motor vehicle violations.

FEMA provides mapped communities with a single paper map of their community. The maps are generally kept in community planning or building permit departments where they should be available for review. In addition, digital flood maps can be viewed on FEMA’s Map Information eXchange (FMIX) website at http://msc.fema.gov. Property owners can also contact us at 973.627.5500.

When you apply for auto insurance, companies consider a variety of factors to determine the risk you represent and the likelihood that you will experience an accident or loss. The company then groups you with policyholders with similar risk characteristics (i.e., tiering), and assigns a rate based on the driving and claims history of your risk group. Not all companies consider the same factors when determining your premium, but there are some common factors that impact rates: driving record, vehicle type, geographic area, gender and age, marital status, vehicle use, policy changes and insurance score.

Insurance may be written on any building eligible for coverage with two or more outside rigid walls and a fully secured roof that is affixed to a permanent site. Buildings must resist flotation, collapse, and lateral movement. The structure must be located in a community that participates in the NFIP.

- Manufactured (i.e., mobile, travel trailers without wheels) homes that are affixed and anchored to a permanent foundation are eligible for coverage.

- Contents coverage for personal belongings located within an eligible building can also be purchased.

Multiple Car/Other Policies— Insuring two or more vehicles on one policy can reduce your premium. Discounts may also apply if you have another policy, such as homeowner’s, renter’s or life insurance, with the same company.

Vehicle Safety Features — Insurers must offer discounts for vehicles that have anti-lock brakes, air bag and passive restraint systems, and anti-theft vehicle recovery systems.

“Good Student / Resident Student” — Many insurers offer discounts for young drivers who maintain a B- or higher grade point average or for those family members attending school over 100 miles away from home and don’t have a vehicle.

Defensive Driving — New Jersey law requires insurers to offer discounts for drivers who have completed a Defensive Driving course approved by the New Jersey Motor Vehicle Commission. (To find an approved school near you, call 1-888-486-3339.)

Buildings entirely over water or principally below ground, gas and liquid storage tanks, animals, birds, fish, aircraft, wharves, piers, bulkheads, growing crops, shrubbery, land, livestock, roads, machinery or equipment in the open, and most motor vehicles are not insurable through the NFIP.

A quote is an estimate of the cost of insurance, based on information supplied to the insurance company by the applicant.

After a community joins the NFIP, a policy may be purchased from any licensed property insurance agent or broker who is in good standing in the state in which the agent is licensed. The agent will complete the flood insurance application, obtain the proper supporting documentation required, and determine the rates for establishing the flood insurance premium.

The steps to purchase flood insurance are as follows:

- Identify the flood zone in which the structure is located.

- Complete the flood insurance application.

- If required, obtain supporting documentation (i.e., elevation certificate, photos, zone determination).

- Submit the completed application, supporting documentation, and full premium to the insurer.

For a quote or more information, contact us at 973.627.5500.

In order to accurately quote you a premium, we will need the following information:

- Make/model/year/vehicle identification number (VIN) of vehicles

- Number of average annual miles (daily miles to work or school)

- Principal owner and operator of vehicle(s) (registration information)

- Driver(s) to be insured on the policy – name, license number, age, sex, marital status (It is important to tell your insurer about all licensed drivers in your household, even if they are covered by other policies.)

- Accidents or moving violations of each driver during the past three years

- Coverages and limits desired

A number of factors are considered in determining the premium for flood insurance coverage. They include the amount of coverage purchased; the deductible amount selected; the flood zone; location; age of the building; building occupancy; and design of the building (foundation type). For buildings in SFHAs built after the community entered the flood program (Post-FIRM), the elevation of the building in relation to the Base Flood Elevation (BFE) is also a factor in determining the premium.

An insurance score is used by insurance companies to predict a consumer’s likelihood to file claims.

Some auto insurance companies in New Jersey are now using your insurance score as one of the various factors to evaluate risks and assign rates. An insurer may use your insurance score, based on information contained in your consumer credit reports, in conjunction with your motor vehicle records, loss reports and application information to determine your insurance risk at a particular point in time.

The Flood Disaster Protection Act of 1973 and the National Flood Insurance Reform Act of 1994 mandate that federally regulated, supervised, or insured financial institutions and Federal Agency lenders require flood insurance for buildings located in a participating NFIP community and in an SFHA. Some financial institutions may require flood insurance for properties outside the SFHA as part of their own risk management process.

While a credit score and an insurance score are both derived from information contained in your credit report, they predict very different things. A credit score is used by banks and mortgage lenders to predict the likelihood that a person will repay a loan or some form of credit debt. An insurance score is used by insurance companies to predict a consumer’s likelihood to file claims.

A major purpose of the NFIP is to alert communities to the danger of flooding and to assist them in reducing potential property losses from flooding. Historical flood data are only one element used in determining a community’s flood risk. More critical determinations can be made by evaluating the community’s rainfall and river-flow data, topography, wind velocity, tidal surge, flood-control measures, development (existing and planned), community maps, and other data. Over time, additional development or changes in these factors can alter the flood risk, and flood maps may be revised.

There are a number of factors that determine insurance scores. One insurer might place more weight on a certain factor while another insurer might not consider it at all. Here is a list of common factors:

- Major negative items (Bankruptcy, collections, foreclosures, liens, etc.)

- Past payment history (Number and frequency of late payments)

- Length of credit history (Amount of time you have been in the credit system)

- Inquiries for credit (Number of times you’ve recently applied for new accounts, including mortgage loans, utility accounts, credit card accounts, etc.)

- Number of open credit lines (Number of open credit cards whether you use them or not)

- Type of credit in use (Major credit cards, store credit cards, finance company loans, etc.)

- Outstanding debt (How much you owe compared to how much credit is available to you)

Lenders are mandated under the Flood Disaster Protection Act of 1973 and the National Flood Insurance Reform Act of 1994 to require the purchase of flood insurance by property owners who acquire loans from federally regulated, supervised, or insured financial institutions for the acquisition or improvement of land, facilities, or structures located within or to be located within an SFHA. The lender reviews the current NFIP maps for the community in which the property is located to determine its location relative to the published SFHA and completes the Standard Flood Hazard Determination Form (SFHDF). If the lender determines that the structure is indeed located within the SFHA and the community is participating in the NFIP, the borrower is then notified that flood insurance will be required as a condition of receiving the loan. A similar review and notification are completed whenever a loan is sold on the secondary loan market or perhaps when the lender completes a routine review of its mortgage portfolio.

Yes. If a lender, its servicer, or a Federal Agency lender requires the escrow of taxes, insurance premiums, fees, or any other charges for a loan secured by improved residential real estate or mobile homes, it shall also require the escrow of all premiums and fees for any flood insurance. This requirement applies to loans made, increased, extended, or renewed on or after October 1, 1996.

Requiring lenders to escrow for flood insurance premiums improves compliance with flood insurance requirements by ensuring that homeowners located in Special Flood Hazard Areas obtain and maintain flood insurance for the life of the loan.

If a lending institution is requiring the insurance to meet mandatory flood insurance purchase requirements, the property owners may not contest the requirement if the lending institution has established the requirements as a part of its own standard lending practices. However, if a lending institution is requiring the insurance to meet mandatory flood insurance purchase requirements, the property owner and lender may jointly request that FEMA review the lending

institution’s determination. This request must be submitted within 45 days of the date the lending institution notified the property owner that a building or manufactured home is in the SFHA and flood insurance is required. In response, FEMA will issue a Letter of Determination Review (LODR). The LODR process should be used as a last resort. Before the LODR process is engaged, the property owners should contact their lender and provide them with additional documentation to support their position.

Some lenders reserve the right in their loan documents to require the purchase of flood insurance regardless of the flood zone. Property owners may not contest the requirement to purchase flood insurance if the lending institution has established the requirement as a part of its own standard lending practice.

- Pay bills on time. Delinquent payments and collections can have a major negative impact on an insurance score.

- Use credit wisely. High outstanding debt can affect an insurance score.

- Apply for and open new credit accounts only as needed. Maintain only the minimum number of credit cards and other credit accounts necessary.

- Remember that the longevity of an account (the amount of time you’ve had it) is considered part of your credit history.

- Make a realistic saving and spending plan and stick to your budget. You are responsible for what you borrow. Examine your financial situation to make sure you are able to repay your debt.

- Check monthly statements and report inaccuracies or mistakes immediately.

- Annually request a copy of your credit report. Review for accuracy and correct all errors in writing. Over time, responsible use of credit can improve a customer’s insurance score. You can get your free reports online at annualcreditreport.com or by calling 1-877-322-8228 or by contacting the agencies directly:

- Equifax: 1-800-685-1111

- Experian: 1-888-397-3742

- TransUnion: 1-800-888-4213

The LODR does not result in an amendment or revision to the NFIP map. It only upholds or overturns the lender’s determination. The LODR remains in effect until the NFIP map panel affecting the subject building or manufactured home is revised. The LODR process does not consider the elevation of the structure above the flood level. It considers only the location of the structure relative to the SFHA shown on the effective FIRM. FEMA confirms the location of the structure on the FIRM by examining the data source used by the lender to make the determination.

A fee must be submitted with all LODR requests. The fee payment may be in the form of a check or money order, in U.S. dollars, made payable to the “National Flood Insurance Program.”

According to the National Safety Council, young drivers as a group are involved in more car accidents than any other driver age group. Lack of experience, higher accident statistics and more costly accidents result in higher insurance rates for novice drivers, especially those under 25. But there is some good news: As long as drivers maintain good driving records, auto insurance rates tend to decrease with age.

Only one building and its contents can be insured on a policy. However, the Dwelling Form of the Standard Flood Insurance Policy (SFIP) does provide coverage for up to 10 percent of the policy amount for appurtenant detached garages.

You should notify your insurer when your teenage is ready to obtain a driving permit. Any change in the insurance cost will either apply when your teenage receives their permit or license, depending on the insurance company’s rating plan. (Remember: Failure to disclose all of the drivers in a household to your insurer can be construed as a form of insurance fraud – which is subject to policy cancellation, civil fine, or penalty under the New Jersey Insurance Fraud Prevention Act.) Most insurers offer discounts for multiple cars, so it will most likely cost less for a young driver to be added to their parents’ policy than to purchase their own. However, any driver with a car titled and registered in their name can purchase insurance.

Flood insurance coverage is available for a 1-year term.

In general, young people away at college are still considered members of their parents’ household and would be covered while driving their own or other autos. As such, you should advise your insurer of your student’s location and current use of vehicles insured under the policy. If your student brings a car with them to school, you will need to notify the insurer that the car will be garaged at another location.

No, there is no minimum coverage requirement if coverage is being purchased voluntarily.

However, if coverage is being purchased as the result of a lender requirement (mandatory purchase requirement), the amount of flood insurance required must be at least equal to the lesser of (1) the outstanding principal balance of the loan, (2) the maximum amount available under the NFIP, or (3) the total insurable value of the property.

Some lenders reserve the right in their loan documents to require the purchase of flood insurance above the amount required by law. If so, they may require the amount of coverage to be as high as the building’s replacement cost value. Property owners should consult with their insurance agent and lender to determine the appropriate amount of insurance to purchase. To contact us, please call 973.627.5500. This does not apply to the Group Flood Insurance Policy (GFIP).

- Enroll in driver training (Many schools offer driver training as part of their curriculum. Check with your insurer if any discount will apply if you complete a program that includes behind-the-wheel training as well as classroom instruction.

- Keep your grades up (Many insurers offer “Good Student” discounts for young drivers who maintain a B- or higher grade point average or for those family members attending school away from home.

- It’s all about the car – The make and model of your vehicle affects the cost of your auto insurance premium. Generally, an older vehicle will cost less to insure, while a high performance or luxury car will cost more.

- Choose a higher deductible (You may reduce your insurance premium by selecting higher deductibles.)

Yes. To recognize policyholders who have built in compliance with the FIRM and/ or remained loyal customers of the NFIP by maintaining continuous coverage, FEMA has “grandfather rules.” These rules allow such policyholders to benefit in the rating for that building. For such buildings, the insured would have the option of using the current rating criteria for that building or having the premium rate determined by using the BFE and/or flood zone on a previous FIRM that was in effect when the building was originally constructed (for those built in compliance) or when coverage was first obtained (for those with continuous coverage). This leads to cost savings to insureds when the new map resulting from a map revision would result in a higher premium rate.

Before an accident:

- Make sure you are sufficiently insured (Read your policy carefully to understand the types of coverage you have purchased and the limits of your coverage. Discuss with your agent what your benefits would be in the event of an accident.)

- Keep your insurance information (and vehicle registration) available at all times because in the event of an accident (or traffic stop) you will be required to present your license, proof of insurance and registration.

- Look for a reputable repair shop – Establish a good working relationship with a repair facility before you need one. You can choose your own licensed repair shop, and insurance law requires that the insurance company attempt to reach an agreement with it regarding the cost to repair your vehicle. If no, the insurance company is obligated to identify other licensed shops that can make repairs at the price determined.

At the scene of an accident:

- Stop the vehicle and remain at the scene (If possible, move out of the way of oncoming traffic, but do not leave the area. Switch on emergency flashers and put out flares, if possible, to alert any oncoming traffic.)

- Call the police (Report the accident and if necessary, request medical assistance.)

- Obtain information – If possible, write down the following:

- Insurance information (including company and policy number) for each vehicle involved in the accident

- Make and model of the vehicles involved in the accident

- Time, date, location, weather and road conditions

- Direction and speed of drivers involved

- How the accident occurred

- Direction and speed of drivers involved

- How the accident occurred

- Names, addresses and phone numbers of any witnesses to the accident

- Names, badge numbers of police officers or emergency personnel, and instructions on how to obtain a copy of the policy report

After the accident:

- Contact your insurance company as soon as possible – Ask your insurer what forms or documents will be needed to support your claim. Current regulations require your company to contact you within 10 working days after it has been notified of a loss; or, within seven working days if it intends to inspect the damaged vehicle. This inspection must be done at a time and place that is reasonably convenient for you. For your own protection, you should contact your insurance company even if you believe you were not at fault in an accident, or if there is no visible damage or injury.

- Get a copy of the police report – Make copies for your own records and your insurance company. Review report for details, such as how many passengers were listed in comparison to how many were present at the accident. If you see inconsistencies, let your insurance company know and contact the police department that responded to the scene.

- Take reasonable steps to protect your property from further damage – For example, if you don’t cover a broken windshield and rain damages your upholstery, your insurer could refuse to pay for the damaged upholstery. Save all receipts for emergency repairs and submit with your claim.

Yes. There is a 30-day waiting period before flood coverage goes into effect. The effective date of a new policy will be:

- 12:01 a.m., local time, on the 30th calendar day after the application date and the presentment of premium.

However, there are exceptions in which the 30-day waiting period does not apply:

- In connection with making, increasing, extending, or renewing a loan, whether conventional or otherwise, flood insurance that is initially purchased in connection with the making, increasing, extending, or renewal of a loan shall be effective at the time of loan closing, provided that the policy is applied for and the presentment of premium is made at the time of or prior to the loan closing.

- In connection with lender requirement, the 30-day waiting period does not apply when flood insurance is required as a result of a lender determining that a loan on a building in an SFHA that does not have flood insurance coverage should be protected by flood insurance. The coverage is effective upon the completion of an application and the presentment of payment of premium.

- When the initial purchase of flood insurance is in connection with the revision or updating of a Flood Hazard Boundary Map (FHBM) or Flood Insurance Rate Map (FIRM): During the 13-month period beginning on the effective date of the map revision, the effective date of a new policy shall be 12:01 a.m., local time, following the day after the application date and the presentment of premium. This rule applies only where the FHBM or FIRM is revised to show the building to be in an SFHA when it had not been in an SFHA.

Automobile insurance is coverage on the risks associated with driving or owning an automobile. It can include collision, liability, comprehensive, medical, and uninsured motorist coverages.

Auto insurance fraud occurs when people knowingly misrepresent pertinent facts to a company or agent to obtain a policy or collect money to which they aren’t entitled.

Presentment of premium is defined as:

- The date of the check or credit card payment by the applicant or the applicant’s representative if the premium payment is not part of a loan closing.

- The date of the closing, if the premium payment is part of a loan closing.

For a loan closing, premium payment from the escrow account (lender’s check), title company, or settlement attorney is considered made at closing, regardless of when the check is received by the writing company.

If you don’t pay your insurance premium, the company will cancel your policy.

Because an insurance policy must provide coverage for every full 24-hour day that it is in force, every insurance policy expires at 12:01am, meaning one minute after midnight on the specified date. Therefore, any premium payment must be received before the cancellation date in order for the policy to remain in force.

Yes, in some cases. For example, if the policyholder sold the property and no longer has an insurable interest in it, the policy can be canceled with a pro-rated return.

However, due to the seasonal nature of flooding, and to protect the lender’s interest, there are limited valid cancellations reasons. The valid cancellation reasons and the proper procedures and documentation required to cancel a policy are outlined in the NFIP Flood Insurance Manual.

To request a cancellation, the policyholder should contact the insurance agent servicing the policy. To contact us, call 973.627.5500.

Insurance rates are based on statistics and probability. Historically, statistics have shown that, while males as a group have only a slightly higher percentage of accidents and violations than females, accidents involving youthful male drivers cause substantially higher amounts of damage and cost the insurance companies considerably more in claim settlement costs than accidents involving youthful females. Therefore, insurance companies are permitted to set rates based on the overall risk of the policy being written.

All policies expire at 12:01 a.m. on the last day of the policy term.

However, coverage remains in force for 30 days after the expiration of the policy, and claims for losses that occur during the period will be honored provided that the full renewal premium is received within 30 days of the policy expiration date.

Coverage also remains in force for the benefit of any mortgagee, but only for 30 days after the mortgagee is notified of the cancellation or expiration.

Business insurance includes a broad range of policy options designed to protect a business from financial loss. Every commercial operation has its own unique set of risks, which means a commercial insurance policy must be tailored to the business. Many factors, from the size of your company, to the number of workers you employ, the materials they handle and whether you have business vehicles, will determine the specific coverage you need to mitigate risk and protect your company’s financials.

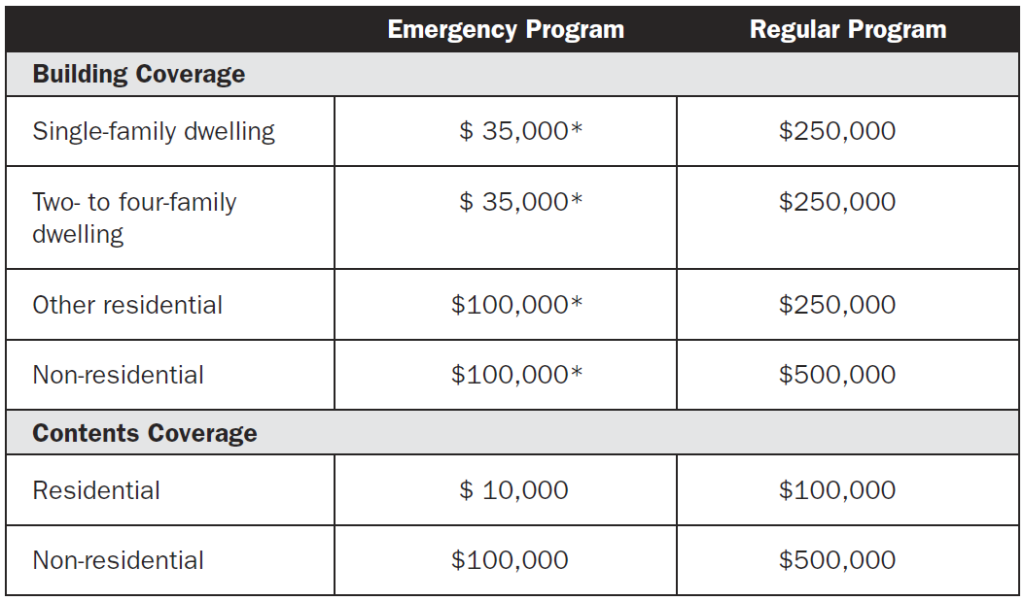

The following coverage limits are available under the Dwelling Form and the General Property Form of the Standard Flood Insurance Policy (SFIP). Coverage limits under the Residential Condominium Building Association Policy (RCBAP) are listed in the NFIP Flood Insurance Manual.

* Under the Emergency Program, higher limits of building coverage are available in Alaska, Hawaii, the U.S. Virgin Islands, and Guam.

Business insurance coverage for a commercial operation can include the following and more:

- General liability insurance: Covers third party liability claims for injuries to other people.

- Professional liability and malpractice insurance: Covers professionals against loss due to negligent professional duty, wrongful acts, and advice and services that lead to another person’s loss or injury.

- Product liability insurance: Covers against faulty products and damage, illness, injury or death that may occur from using a faulty product.

- Property insurance: Covers loss and damage to your commercial business property due to fires, storms and other causes.

- Commercial vehicle insurance: Covers commercial vehicles and drivers for collision, liability, property damage, personal injury and “comprehensive” (now known as “other than collision”).

- Workers compensation: Covers your employees if they become ill or injured while working on the job.

- Loss of income: Covers your business expenses such as rent and employee wages if you can’t operate your business.

- Key person insurance: Covers loss of income that may result from the head of the business or other key personnel becoming incapacitated or passing away (also known as key man insurance).

- Cyber-crime insurance: Provides protection for risks due to Internet use and online communications.

- Records retention policies: Covers loss of important data and financial records.

- Specialty coverage: Insurance that covers various specific business risks, such as those of landlords, farmers, and commercial operations that put on one-day events, such as seminars or concerts.

Business insurance is a contract between the insurance company and the business. The insurance company agrees to share the business risk with the business entity in exchange for premium payments. In the event of a covered loss, the insurance company pays for the financial losses the business incurs up to the limit of the policy after the deductible amount is paid by the business filing a claim.

At the time of a loss, the business will typically file a claim. If a fire destroys a portion of the business premises, for example, the company will file a claim against the property insurance policy. An adjuster will assess the damage and process the claim. The company will then receive the appropriate amount of compensation for the loss.

There are many different scenarios with regard to business risk and how insurance claims are filed. For example, in the event that the incident is a loss suffered by a customer of the company, the injured party will likely file a claim against the businesses’ liability policy. How the claim is processed depends upon the size of the claim, whether the matter can be settled with an insurance payment, and if the claim results in a lawsuit.

Direct physical losses “by flood,” losses resulting from flood-related erosion caused by waves or currents of water activity exceeding anticipated cyclical levels, or caused by a severe storm, flash flood, abnormal tidal surge, which result in flooding, as defined in the SFIP. Damage caused by mudflows, as specifically defined in the policy forms, is covered.

The cost of business insurance varies. A number of factors affect how much business insurance costs, because it depends on the type of business and the types of coverage appropriate for that commercial operation. Cost also depends on the size of the business. A small, home-based business can often be adequately insured for $500 per year, while insurance for a large company with many employees and a wide range of business risks could $500,000 per year.

To find out more information or to get a quote, contact us at 973.627.5500.

A minimum deductible is applied separately to a building and its contents, although both may be damaged in the same flood. Optional deductibles are available, and an insurance agent can provide information on specific amounts of available deductibles. Optional high deductibles reduce policy premiums but will have to be approved by the mortgage lender.

When a building is under construction, alteration, or repair and does not have at least two rigid exterior walls and a fully secured roof at the time of the loss, the deductible amount will be two times the deductible that would otherwise apply to a completed building. The deductible does not apply to:

- Loss avoidance measures;

- Condominium loss assessments; or

- Increased cost of compliance.

Business insurance is tax deductible, as long as the coverage is for the purpose of operating a business, profession, or a trade. Businesses may not deduct their business insurance premiums if the coverage is for the purpose of a self-insurance reserve fund or a loss of earning insurance policy.

Some are. When an insured building is in imminent danger of being flooded, the reasonable expenses incurred by the insured for the removal of insured property to a safe location and return will be reimbursed up to $1,000, and the purchase of sandbags and sand to fill them, plastic sheeting and lumber used in connection with them, pumps, fill for temporary levees, and wood will be reimbursed up to $1,000. No deductible is applied to this coverage.

Note: The coverage for Sandbags, Supplies, and Labor applies only if damage to insured property by or from flood is imminent, and the threat of flood damage is apparent enough to lead a person of common prudence to anticipate flood damage.

One of the following must also occur:

(a) A general and temporary condition of flooding in the area near the described location must occur, even if the flood does not reach the insured building; or

(b) A legally authorized official must issue an evacuation order or other civil order for the community in which the insured building is located calling for measures to preserve life and property from the peril of flood. This coverage does not increase the Coverage A or Coverage B limit of liability.

For additional information, refer to any of the SFIP forms, Section III. Property Covered, Part C. Coverage C – Other Coverages: 2. a. and b.

Business insurance is required by law, but only under certain conditions. The following business insurance is required by law if it is applicable to your situation:

- Unemployment insurance: Applies to a business that has employees and may be obligated to pay unemployment insurance taxes under prescribed conditions; if these conditions are applicable to your business, then you must register your business with the state work force’s agency.

- Workers compensation insurance: If your business has employees, you are most likely legally obligated to carry workers’ compensation insurance, either on a self-insured basis or through a commercial insurance carrier or a state worker’s compensation program. Workers compensation laws vary by state.

- Professional liability insurance: Some states require specified professionals to carry insurance against professional liability.

- Disability insurance: Several states require that a business have partial wage replacement insurance coverage for employees eligible for non-work related injury or illness. These states include California, Hawaii, New Jersey, New York, Puerto Rico and Rhode Island.

Replacement cost coverage is available for a single-family dwelling, insured under the Dwelling Form that is the policyholder’s principal residence and is insured for at least 80 percent of the building’s total insurable value at the time of the loss, or the maximum amount of insurance available under the Program. Replacement cost coverage does not apply to manufactured (i.e., mobile) homes smaller than certain dimensions specified in the policy.

Losses are adjusted on a replacement cost basis for residential condominium buildings insured under the Residential Condominium Building Association Policy (RCBAP). However, coverage amounts less than 80 percent of the building’s full replacement cost value (RCV) at the time of loss will be subject to a coinsurance penalty.

Building losses under the General Property Form are always adjusted on an actual cash value basis.

Contents losses are always adjusted on an actual cash value basis. Actual cash value means the replacement cost of an insured item of property at the time of loss, less the value of physical depreciation of the item damaged.

Depending on the nature of your business and any insurance which you are legally obligated to carry, the following types of business insurance should be considered essential:

- General liability insurance: Coverage against accidents, injuries and negligence claims

- Product liability insurance: Coverage against product defects

- Professional liability insurance: Covers professionals against malpractice, negligence or errors

- Commercial property insurance: Covers against damage to your business property, such as from fire or a severe storm

- Business interruption insurance: Protects your business if you are no longer able to conduct your business because of a loss

- Home-based business insurance: Covers against general or professional liability.

Because commercial insurance needs to be tailored to each business based on risks, it is critical to work with an agent who will get to know your company and ensure that your coverage adequately protects your business investment. For more information on what type(s) or business insurance you need, contact us at 973.627.5500.

No. The policy covers only direct physical flood damage to the dwelling and does not provide for additional living expenses.

In order for your business insurance to cover flood damage, your company must carry a separate flood insurance policy or endorsement. The typical commercial property insurance policy covers specific water damage situations but excludes flooding. The wording and water damage exclusions vary from one insurance company to another. Be sure to review your policy carefully and discuss your specific risks and concerns with your insurance company or you can contact us at 973.627.5500.

Increased Cost of Compliance (ICC) coverage under the SFIP provides for the payment of a claim to help pay for the cost to comply with state or community floodplain management laws or ordinances from a flood event in which a building has been declared substantially damaged or repetitively damaged. When an insured building is damaged by a flood and the state or community declares the building to be substantially damaged or repetitively damaged, ICC coverage will help pay for the cost to elevate, floodproof, demolish, or relocate the building up to a maximum benefit of $30,000. This coverage is in addition to the building coverage for the repair of actual physical damages from flood under the SFIP.

Business insurance covers lawsuits as long as you have the appropriate business liability insurance for your situation and enough liability coverage to pay your legal costs. To ensure that enough liability coverage is in place for extreme circumstances like a lawsuit that exceeds $1 million in damages, many businesses buy a commercial umbrella liability policy.

Certain liability exclusions also apply, such as if an injury or damage was expected, or was caused intentionally. Some policies also have something called a “workmanship” exclusion, and some exclude coverage of punitive damages. Liability insurance is available in many different forms, including:

- General liability

- Professional liability, “errors and omissions” and malpractice

- Directors and officers liability

- Product liability

- Premises or property liability

- Employer’s liability

- Employment practices liability

- Environmental and pollution liability

Yes. The maximum amount a policyholder may collect under ICC is $30,000. This amount is in addition to the amount the policyholder receives for physical damages by flood. The total amount the policyholder receives for combined physical structural damage from flood and ICC is always capped by the maximum limit of coverage established by Congress. The maximum amount collectible for both ICC and physical damage from flood for a single-family dwelling is $250,000.

General liability insurance provides insurance protection for a company’s assets, financial obligations, legal defense, and any settlements or judgments awarded to an injured party. It may also include claims for copyright infringement, false or misleading advertising, or libel and slander. If a patron is injured in some way in the course of doing business with your company, your general liability insurance will provide coverage.

Yes—however, not all buildings are eligible for ICC coverage. To be eligible for ICC coverage, a building must be declared substantially damaged, and there must be mitigation activities to reduce the building’s exposure to future flood damage. Refer to Section D of the policy form for more information regarding ICC coverage.

Errors and omissions insurance (or “E and O”) covers a business for a service rendered which did not have the expected or promised results, or which results in a loss or personal injury suffered by the person receiving those services. It also covers situations where the individual or company failed to render service at all. These are known as errors and omissions. As an example of errors and omissions insurance, if a financial advisor provided investment advice that resulted in a client’s financial loss, those circumstances could result in an errors and omissions liability claim.

This type of insurance is also known as malpractice insurance (for medical practitioners) and professional liability insurance for practicing lawyers and other professionals.

A flood insurance policyholder should immediately report any flood loss to the insurance company or agent who wrote the policy. If your policy is with our office, you can contact us at 973.627.5500 to file a claim. A claims adjuster will be assigned the loss, and the policyholder must file a “proof of loss” within 60 days of the date of loss. The 60-day time limit for filling a proof of loss remains the same.

A business owner’s policy or “BOP” is insurance coverage designed specifically for small or medium-sized businesses. Depending upon the insurance company, the size of business that qualifies for a business owner’s policy may be based on revenues or number of employees. A BOP combines several types of insurance coverage in a packaged format, and can be customized to suit a particular business. Generally, this type of policy includes both property and liability coverage.

Policies may also provide coverage to include the following:

- Property claims

- Breakdown of equipment

- Loss of income/business interruption

- Professional liability

- Copyright infringement

- Libel

- Products and completed operations

- Premises liability

A proof of loss—the policyholder’s valuation of claimed damages—is a sworn statement made by the policyholder that substantiates the insurance claim and is required to be submitted to the NFIP or company within 60 days of the loss. A printed form usually is available from the adjuster assigned to the claim.

Note: Some companies and agents may require the proof of loss to be affirmed by a public notary.

To get more information or a quote, contact us at 973.627.5500.

A loss in progress occurs when actual flood damage to a building or its contents started before the inception of the policy, or when coverage is added at the insured’s request when a flood is imminent.

If you have a Business Auto Insurance policy with comprehensive and collision coverage, you can usually select rental reimbursement as a coverage option which reimburses you for a car rental for up to 30 days after a covered claim, up to the dollar amount per day that’s shown on your Policy Declarations.

The NFIP does not cover damage caused by a loss in progress under any of the flood insurance policies.

If you chose to submit the claim on your policy, we will work aggressively to attempt to recover money paid on your claim, including your deductible. The recovery process, which is known as subrogation, can typically take several months to complete.

An insured will never be paid more than the value of the covered loss, less deductible, up to the amounts of insurance purchased. Therefore, purchasing insurance to value is an important consideration. The amount of insurance a property owner needs should be discussed with an insurance agent or broker.

For more information, contact us at 973.627.5500.

No. However, carriers often offer Inland Marine Insurance with affordable coverage options for tools, equipment and merchandise while they are in transit, in the business vehicle or at the job site.

Elevating a structure on posts or pilings does not remove a building from the SFHA. If the ground around the supporting posts or pilings is within the floodplain, the building is still at risk. Ground saturation can lead to decreased load-bearing capacity of the soil supporting the posts or pilings, which can lead to partial or full collapse of the structure. Flood insurance will be required as a condition of receipt of Federal or federally regulated financing for the structure. FEMA recommends securely elevating structures above the SFHA to reduce the risk to life and property, and has established a rating structure that could result in significant savings in premium costs for those who elevate.

Non-Owned Automobile Liability coverage, protects you for injury or damage caused by your employees when they are driving their own vehicles for your business operations. This coverage would be excess over any liability coverage that is carried on the employee’s vehicle. Non-Owned Automobile Liability can often be added onto your policy by endorsement.

Elevating a structure on posts or pilings does not remove a building from the SFHA. If the ground around the supporting posts or pilings is within the floodplain, the building is still at risk. Ground saturation can lead to decreased load-bearing capacity of the soil supporting the posts or pilings, which can lead to partial or full collapse of the structure. Flood insurance will be required as a condition of receipt of Federal or federally regulated financing for the structure.

FEMA recommends securely elevating structures above the SFHA to reduce the risk to life and property, and has established a rating structure that could result in significant savings in premium costs for those who elevate.

Small businesses such as retail stores or restaurants, and independent contractors need business owners insurance to safeguard against unexpected financial loss.

As a small business owner, you’re exposed to many risks. An accident caused by you or one of your employees could result in a lawsuit that puts you out of business. Business Owners insurance could prevent this from happening by providing liability protection.

As a contractor, you’re generally required to carry business liability insurance that protects the interests of a property owner or the worksite’s general contractor.

Flood hazard areas are determined using statistical analyses of records of riverflow, storm tides, erosion, wave heights, and rainfall; information obtained through consultation with the community; floodplain topographic surveys; and coastal, hydrologic, and hydraulic analyses. The FIS covers those areas subject to flooding from rivers and streams, along coastal areas and lakeshores, and/or shallow flooding areas.

A claim is a request to an insurer for payment or reimbursement of a loss covered by the

terms of an insurance policy.

To file a claim, call us in the office at 973.627.5500 and we will walk you through the process.

A Flood Hazard Boundary Map (FHBM) is based on approximate data and identifies the SFHAs within a community. It is used in the NFIP’s Emergency Program for floodplain management and insurance purposes. A FIRM or Digital Flood Insurance Rate Map (DFIRM) is normally issued following a flood risk assessment conducted in connection with a community’s conversion to the NFIP’s Regular Program. If a detailed assessment, termed a Flood Insurance Study (FIS), has been performed, the FIRM will show Base Flood Elevations (BFEs) and insurance risk zones in addition to floodplain boundaries. The FIRM may also show a delineation of the regulatory floodway. After the effective date of the FIRM, the community’s floodplain management ordinance must be in compliance with appropriate Regular Program requirements. Actuarial rates, based on the risk zone designations shown on the FIRM, are then applied for newly constructed, substantially improved, and substantially damaged buildings.

Every claim is unique, and there are a lot of different things that could affect how long it takes to resolve your claim.

Keep in mind that even though filing a claim is probably a rare event for you, our claims teams are made up of experienced professionals who work with issues similar to yours day in and day out. They’ll always do their best to get your claim resolved efficiently.

You can help your claim go smoothly by providing your insurance carrier with all the information you can about the incident. Talk with your claims team to make sure you’ve given them all the documentation and details they need.

Your deductible is the amount you’ve agreed to pay out of your pocket before your insurance carrier pays for any covered losses.

Here’s an example. Say you have $2,000 worth of covered damage, and you picked a $500 deductible, applicable to that coverage, when you bought the policy. That means you pay $500, and your auto insurance pays the rest.

Regardless of who was at fault, you’ll pay a deductible for certain coverages. However, during the claim investigation, if the facts indicate there’s a chance to recover the damages from the person responsible for the accident, we’ll attempt to recover them, including your deductible. If we aren’t successful, you have the option of trying to recover the deductible on your own.

The decision whether to repair or declare a vehicle a total loss is based on the type and the extent of damage, age of the vehicle, state law, and other factors. In order to make a decision, we may have to inspect your vehicle. If the repair estimate is more than the vehicle’s worth, we will pay the actual cash value of the vehicle, up to the limits of the policy, minus your deductible.

It is common for an auto body repair shop to find additional damages that were not on the original estimate. The auto body shop will often work directly with the insurance carrier to request a supplement for any additional loss-related damage.

Every policyholder’s situation is unique, so depending on your circumstances, your premium may be affected. If you are concerned, don’t hesitate to discuss with your agent. You may also want to ask them about other auto products that include things like an Accident Forgiveness feature which may help prevent your rates from going up just because of an accident, even if it’s your fault.

An agent is a licensed person or organization authorized to sell insurance by or on behalf of an insurance company.

Automobile insurance is coverage on the risks associated with driving or owning an automobile. It can include collision, liability, comprehensive, medical, and uninsured motorist coverages.

A binder is a temporary or preliminary agreement which provides coverage until a policy can be written or delivered.

A claim is a request to an insurer for payment or reimbursement of a loss covered by the

terms of an insurance policy.

Deductibles are payments you have to make before the insurer pays for a covered loss. For example, a $750 deductible means that you pay the first $750 of each claim. You may choose a higher deductible to lower your premium.

Depreciation is the decrease in value of property over time because of age or wear and tear, and the like.

An endorsement is an amendment to the policy used to add or delete coverage.

An exclusion is certain causes and conditions, listed in the policy, which are not covered.

An expiration date is the date on which the policy ends.

Face amount means the dollar amount in a life insurance policy to be paid to the beneficiary when the insured dies. It does not include other amounts that may be paid from insurance purchased with dividends or any policy riders.

A grace period is the period after the premium due date, during which an overdue premium may be paid without penalty. The policy remains in force throughout this period.

Guaranteed insurability is an option that permits the policyholder to buy additional stated amounts of life insurance at stated times in the future without evidence of insurability.

An inception date is the date on which a policy begins.

The insured is the policyholder, the person(s) protected in case of a loss or claim.

The insurer is the insurance company.

Life insurance is a policy that will pay a specified sum to beneficiaries upon the death of the insured.

A limit is a maximum amount a policy will pay either overall or under a particular coverage.

Material misrepresentation is a false statement of an important fact on an application; for instance, false information regarding the location where a vehicle is garaged.

A peril is an event that causes loss or damage to property. Fire, windstorm, and theft are examples of specified perils (called Named Perils in insurance-speak).

A policy is the written contract of insurance.

Premium is the amount of money an insurance company charges for insurance coverage.

A quote is an estimate of the cost of insurance, based on information supplied to the insurance company by the applicant.

Replacement cost is the cost to repair or replace an insured item. Some insurance only pays the actual cash or market value of the item at the time of the loss, not what it would cost to fix or replace it. If you have personal property replacement cost coverage, your insurance will pay the full cost to repair an item or buy a new one.

Replacement value is the full cost to repair or replace the damaged property with no deduction for depreciation, subject to policy limits and contract provisions.

Reinstatement is the restoring of a lapsed policy to full force and effect. The reinstatement may be effective after the cancellation date, creating a lapse of coverage. Some companies require evidence of insurability and payment of past due premiums plus interest.

The amount of money the insurance company has to give back to you in the event of a cancellation of your policy.

A surcharge is an extra charge applied by the insurer.

Surrender means to terminate or cancel a life insurance policy before the maturity date. In the case of a cash value policy, the policyholder may exercise one of the nonforfeiture options at the time of surrender.

Underwriting is the process of selecting applicants for insurance and classifying them according to their degrees of insurability so that the appropriate premium rates may be charged. The process includes rejection of unacceptable risks.

A waiting period is a period of time set forth in a policy which must pass before some or all coverages begin.

- Owners need it to protect their home(s) and their personal property.

- Renters need it to protect their personal property.

- Both need it to protect against liability for injuring third persons or damaging their property.

- That depends on the value of your property. The more coverage you buy, the less you will have to pay out of your own pocket if you suffer a loss that damages your house or its contents.

- You also need enough personal liability coverage to protect you from claims brought against you by others.

- Your bank or mortgage company may insist that you insure your house for at least the amount of the mortgage.

- Insurers may require you to insure your house for a certain limit in order to obtain replacement cost coverage.

- Not necessarily. Mortgage lenders do require some kind of homeowners insurance because, like you, they have a big investment in your home. But mistakes do occur and messages do get lost. Some mortgages do include insurance premium payments in your monthly mortgage bills, but some do not.

- You may think the mortgage lender is paying for the insurance while the lender thinks you are paying for it.

- Ultimately it is your responsibility to know who is insuring your home and whether the premium has been paid.

- Contact your lender and insurance company to make sure your policy is in place and the premium is getting paid.

- Important Note: Some mortgage companies will supply a policy called “forced coverage” if a standard policy is not maintained. These policies are very expensive and protect only the interest of the mortgage company on the structure itself. It does not protect you or your belongings.

Wrong! A homeowner’s insurance policy may be one of the best investments you ever make. But that investment only pays off in very specific situations. If something you want to protect isn’t specifically listed in your policy, it probably isn’t covered.

- Your policy may pay for the repair or replacement of your house, but may not pay for the furniture and other contents.

- Some things inside your home may be covered while others are not, and damage from some kinds of disasters, such as floods, aren’t covered at all by ordinary policies.

- It is important to read your policy carefully and think about the amount of protection you need. If you want a type of coverage not listed in your policy, ask your insurer how to get it.

A number of factors influence the premium that you may be charged:

- Type of Construction: Brick houses usually have lower premium rates because they are less vulnerable to fire.

- Age of the House: Newer houses usually have lower premium rates than older ones. Some insurers may not want to cover very old houses at all or may provide only limited coverage.

- Fire Protection: Your home’s distance from a fire hydrant and the quality of your local fire department affect the price you will be charged.

- Amount of Coverage: The amount of coverage you buy will affect the price you pay.

- Deductible Amount: The higher the deductible you choose, the lower your premium will be.

- Discounts: There may be discounts available for such things as smoke alarms or security systems.

- That depends on what you think you can afford to pay out of your own pocket in the event of a loss. The deductible applies only to property damage to your home or to its contents.

- There is no deductible on the personal liability portion of the policy that covers you for claims brought by others.

- A policy with a $500 deductible will cost less than one with a $250 deductible. You need to figure out what would be the highest amount that you could comfortably handle.

Whether you own or rent, there are different coverage packages available in the marketplace.

- Each package protects against certain specified perils – a peril is an event that causes loss or damage to property. Fire, windstorm, and theft are examples of specified perils (called Named Perils in insurance-speak).

- The policy usually covers: Property Damage, Additional Living Expense, Personal Liability, and Medical Payments.

- Homeowner’s insurance policies apply, typically, to most owner-occupied single family homes and are modified somewhat to fit the needs of Renters and Condominium Owners.

A peril is an event that causes loss or damage to property. Fire, windstorm, and theft are examples of specified perils (called Named Perils in insurance-speak).

Property Damage coverage helps to pay for damage to your house or to your Personal Property.

- Other structures such as detached garages and tool sheds are also covered.

- You need to check with your agent or insurance company to determine if the amount of coverage on other structures is sufficient for your needs.

- You can choose to cover your house and contents for either Replacement Cost or Actual Cash Value

Personal Property is the contents of your home and other personal belongings owned by you and family members living with you.

Replacement Cost is the amount it would take to replace or rebuild your home or repair damage with materials of similar kind and quality without any deduction for depreciation.

- Whether your home is insured for replacement value or actual cash value, it is important to keep track of its value. Check with your agent or insurance company at least once a year to make sure that your policy provides adequate coverage.

Depreciation is the decrease in value of property over time because of age or wear and tear, and the like.

Actual Cash Value (often referred to by its initials as ACV) is the amount it would take to repair or replace property less depreciation.

Motor vehicles are NOT covered. There may be limited coverage for small boats. Check with your agent if you own a boat or a snowmobile or other recreational equipment.

Some forms of Personal Property such as jewelry, antiques, silverware, collectibles, computers, money and the like have some limited coverage under your policy but may need more coverage. Check with your agent about adding more coverage.

Most policies agree to pay some expenses if your home is damaged and you cannot live there while repairs are being made.

- These expenses could include limited hotel and restaurant costs and storage charges.

- You should realize, however, that you can claim Additional Living Expense only if the loss is caused by a covered peril.

This coverage protects you against claims brought against you by others asserting that they were hurt or that their property was damaged by something you did or failed to do.

- Personal Liability coverage will pay the claim and your legal fees but only up to the limit of liability so you need to be sure that you have picked a limit that you are comfortable with but which you also can afford.

- This coverage protects you and your family members who live with you.

- A couple of other things you need to know are that 1.) there is often no coverage if the claims against you are related to the operation of an auto or arise out of business activities; and, 2.) there is often no coverage for injury or damage that is intentionally caused by you or the members of you household.

Regardless of who is at fault, this coverage pays medical expenses for others accidentally injured on your property.

- Medical Payments coverage does not apply to you or members of your family who live with you.

- Like Personal Liability it also does not apply to injuries arising out of the operation of an auto or from activities involving your at-home business.